In the last couple of weeks the stock market got hit hard by the latest coronavirus spread news. This is considered to be a correction but some are more bearish and think that this might be the beginning of a recession.

In this post I’ll share my thoughts on it and how I think it could affect the market. I’ll also talk about how my portfolio is holding up and what moves and trades I’m making with the current dip.

Threat To Stock Market

If coronavirus turns out to be a big threat and global pandemic then the market is definitely will be affected. As it stands today we’ve only seen heavy selling of stocks, pretty much in all industries, as an emotional fear reaction and not as a response to actual companies' revenues dropping. The earnings season is almost over and the majority of the US companies, and tech companies that I focus on specifically, show good earnings with no signs of slowdown due to the virus.

Although several companies such as Apple, Starbucks, and others warned that their guidance for revenue and profits will be lower in the next quarter (Q1 of 2020) due to virus concerns or factory/store closures in response to quarantines or general virus fear.

I think the biggest impact the virus is going to have, if it spreads further, would on businesses that have physical

locations and that rely on supply chains that will be disrupted across the globe. Apple, Disney, Nike, Starbucks are

examples of that.

Also, companies with heavy China exposure either as consumer market or as manufacturing wing will be affected

heavily as well. Tesla, Apple, and Nike with their factories there come to mind.

The companies that will get less affected are purely software companies with no physical locations. Atlassian (TEAM), Microsoft (MSFT), Netflix (NFLX), Facebook (FB) and many others that just deliver stuff over the web will be fine because even if we have a global pandemic and people stay at home they are likely will keep using products of those companies either to do work remotely or for entertainment.

My Portfolio

My portfolio is split in two these days:

- one is growth tech stocks

- another one is more conservative dividend-paying stocks.

Both got heavy drops in the last 2-3 weeks.

Growth

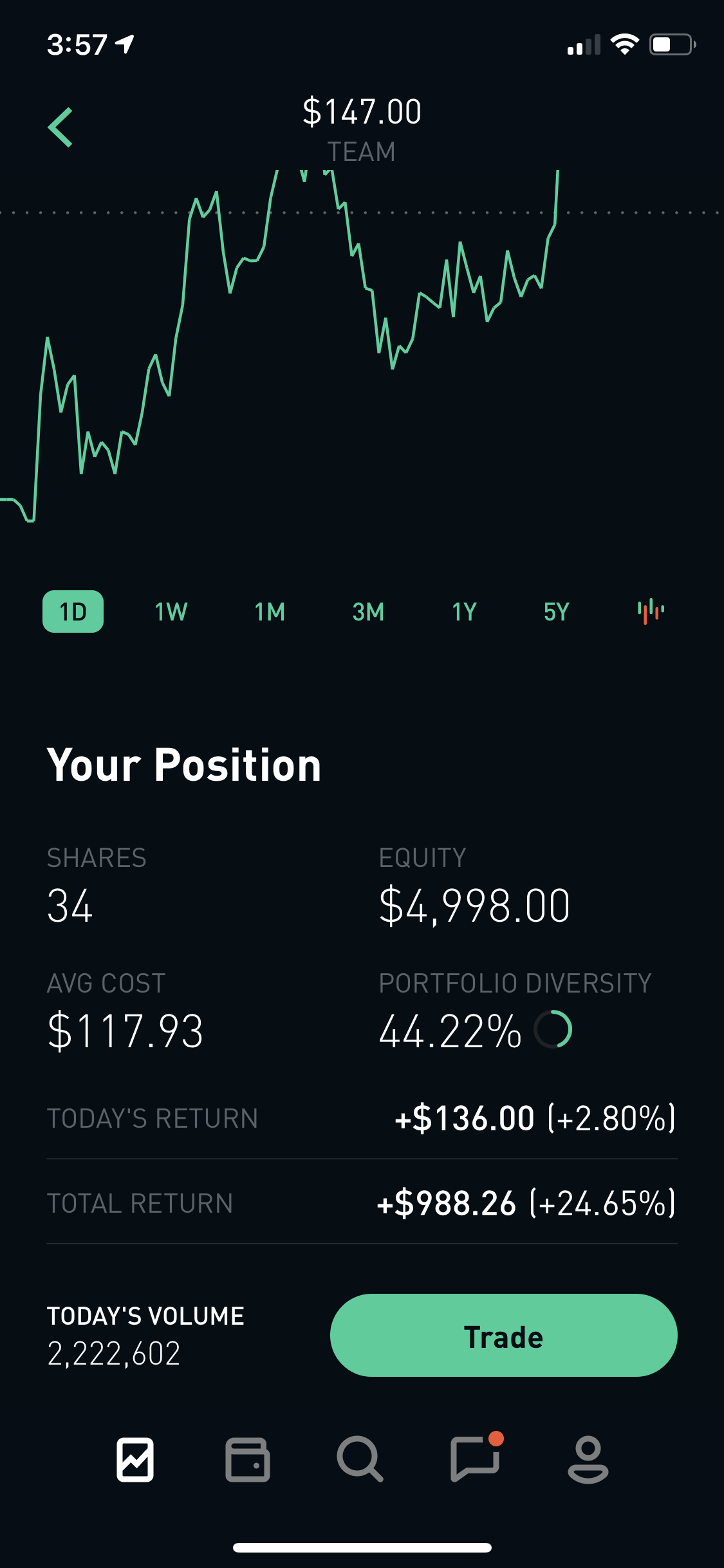

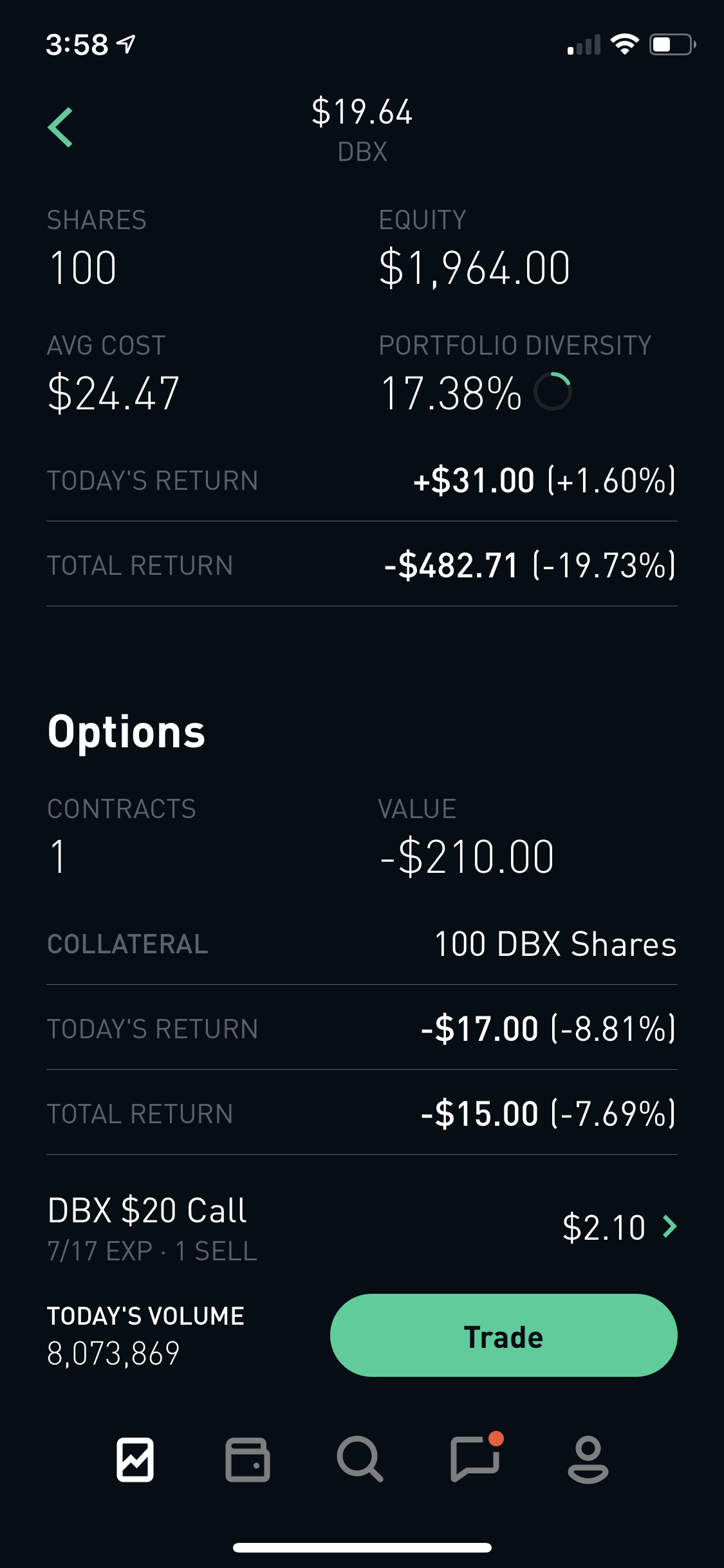

My growth tech portfolio primarily consists of Atlassian (TEAM) and Dropbox (DBX).

Atlassian is my main holding is about 50-60% of my growth portfolio. I bought most of the shares I own back in August/October when it was trading around $114 per share. A few weeks ago, right after Q4 2019 earnings, I was up around 30% on it but now since the latest coronavirus news, I’m up only about 20%.

Dropbox has been an ongoing experiment for me. I bought 100 shares of it around the time of its IPO for ~$24.47 a share. Since then it’s been in a constant decline but in my experiment I was selling weekly CALL contracts on those 100 shares and collected about $297 in profit. Although right now I’m -19% down on the shares themselves. Another issue is that with the latest earnings DBX jumped faster than I could properly roll it so I had to roll my call position first to January 2021 but then later to July 2020 when it went back down again. My DBX experiment is a topic on its own and I’ll covert sometime in another blog post.

Dividends

My dividend portfolio consists of mainly 4 things:

- Telecom. AT&T (T)

- Biotech. AbbVie (ABBV)

- Old boring tech. IBM (IBM)

- Real Estate. A collection of various REITs such as Tanger Factory Outlet Centers Inc (SKT), New Residential Investment Corp (NRZ), and a bunch of others

I’m very happy with AT&T and AbbVie in my portfolio, they are solid dividend aristocrats (companies that paid and raised dividends consistently for more than 25 years in a row) that provide consistent cash flow in my portfolio.

IBM and Real Estate stocks I have are more of an experiment but all of them have a proven record of paying dividends.

I’ve been slowly buying all of these companies over the last year.

Trades I’m Making In Response To This Correction

I think this correction is a great opportunity to get good tech software stocks and dividend stocks for discount. I won’t be selling any of my positions because as I mentioned before so far the selloff was simply panic and in response to any actual changes in companies' fundamentals.

I’ll be doubling down and buying more of Atlassian (TEAM), Microsoft (MSFT), Facebook (FB), Google (GOOG), Intuit (INTU), and Okta (OKTA). All of these companies have software-only based businesses (except MSFT and GOOG but their hardware revenue shares are fractions of their software income) and as I mentioned in the section above I believe software businesses will have the least impact due to coronavirus. Also, these companies (except FB) make B2B products sales of which shouldn’t be affected by slowed consumer spending.

Other companies that I’m considering buying are Visa (V), Mastercard (MA), and Amazon (AMZN) but I’m cautious here because if global spending will be affected due to the virus then all of those companies bottom line will be affected in the following quarters.

I’m also will be buying as much as possible of AT&T as it dipped along with the rest of the market on coronavirus news. AT&T is my favorite dividend stock with solid cash flow business that’s been around for ages. Even if coronavirus will affect the market significantly everyone will still need reception on their cell phones which means AT&T’s core business will still be bringing revenue.

Conclusion

Full disclosure, this is not an investment advise, use this information at your own discretion, I’m only sharing my personal thoughts and what I’m planning to do for myself.

If you have any questions feel free to email me at alex.bush@smartcloud.io

Also, I use Robinhood and M1 Finance as my two main brokerages. They have various features I like and both have commission-free trading. If you’d like to open accounts with them consider using my referral links:

P.S.

I’m working on a book about stock trading with Robinhood app. Sign up here to hear updates about it if you’re interested.